2772Views 0Comments

How Can You Get Rich By Trading Forex?

Can Forex trading make a person rich, is a question that most of the traders have in their mind. Forex trading may make you rich if you are highly skilled in trading and have lots of money to invest. For a normal trader with average experience in trading, Forex trading can be a bumpy road which can lead to big losses and penury.

According to an article published in Bloomberg, 68% of the investors lost their money in Forex trading. The report was based on the clients of two big Forex companies – Gain Capital Holding Inc. and FXCM Inc. This can be interpreted that about one in three doesn’t lose their money in Forex trading, but that doesn’t mean that trading in Forex is the easy way to make gains.

Forex trading is full of uncertainty. Even a little fluctuation in the market and political upheaval can erode the capital of the investors, rendering them insolvent. Here are a few reasons to prove why the odds are against the trader who wants to get rich through Forex trading:

- Leverage – Currencies are volatile, and the allure of forex trading is in the leverage offered by brokers that can magnify gains as well as losses. Due to the proliferation of many trading platforms and easy availability of the credit, people are inclined towards Forex trading.

- Asymmetric risk – Experienced forex traders strategize and keep their loss small and compensate it with the gains when their prediction goes in the right direction. Novice traders, on the other hand, make small profits but tend to keep the losing trade for too long, resulting in substantial loss.

- Platform Malfunction – Sometimes there is platform malfunction or system failure which prevents you from participating in the trade. Suppose you have a large position and you cannot close the trade because of the internet overload or computer crash. This is one of the worse things to imagine if you are a trader, but things like this happen.

- OTC market – Being an over the counter market, the Forex market is not a regulated market. Due to an unregulated market, it gives rise to counterparty risk.

Tips that you should take when using leverage in Forex trading:

- Cap your losses – You should know how to keep your losses small. Cap your losses to the manageable limits before they become too much to handle and completely erode your profit.

- Put stops – Stops, if used strategically, are of great importance if you don’t want to get up in the morning only to find out that the position you were holding is drastically affected by a move of a couple of hundreds of pips. Stops not only prevent you from losing money, but it also helps you in protecting your profits.

- Use leverage which suits you the best – If you are new to trading or are cautious investor use low leverage that you are comfortable with.

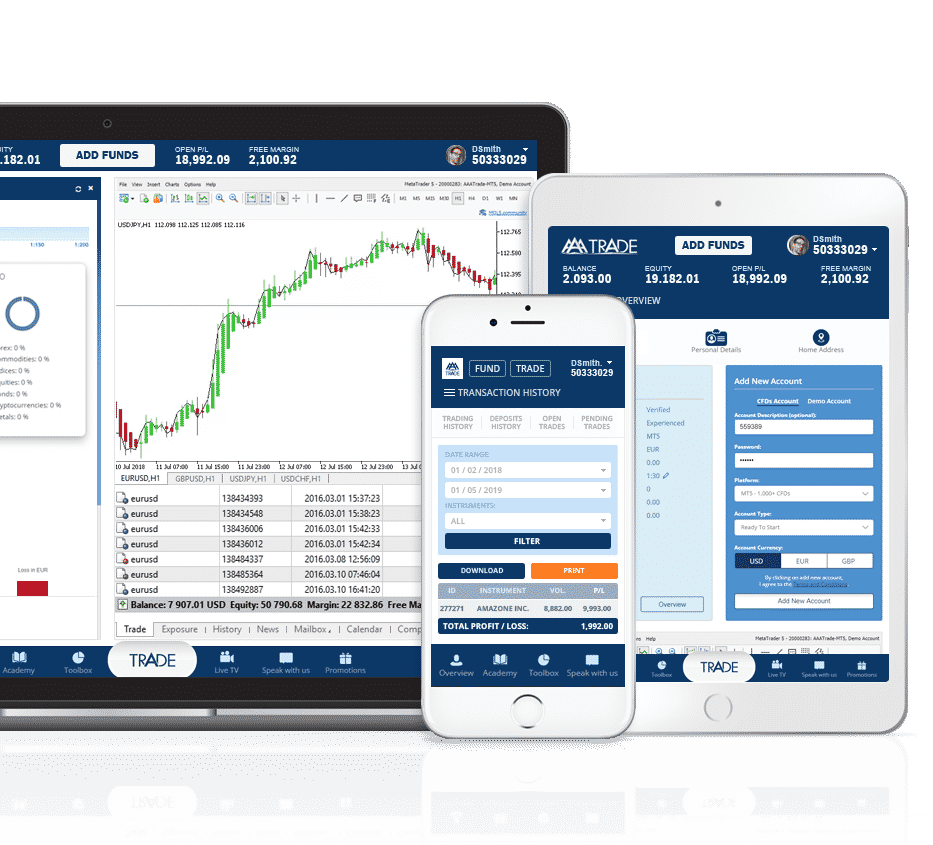

While forex trading is surrounded by a high degree of risks, taking a few precautions can make your journey easier. Also, you need a reputed platform to trade in Forex. AAATrade.com is the best online broker for forex trading due to its intuitive platform that it offers to its clients.